This will rise to £ 8. Same as the rest of the UK. A development rate of £4. Hi the minimum wage is £4. After it goes up to £5. It is set by the UK Government. The government sets a minimum amount you must get paid on average for the hours you work. Current rates for the minimum wage. The rates change every April. The national minimum wage is set to rise to £8. Businesses can pledge to pay their. Contracts for payments below the minimum wage are not legally.

The decisions followed over a year of research into trainee remuneration including a survey of 6solicitors, student and trainees on the recommended rate. Sam gets paid monthly on the 15th of the month. GMB Calls For £An Hour Social Care Minimum Wage As New Report Reveals “Chronic Exploitation” Of Frontline Staff. Britain’s lowest-paid workers are set to receive the smallest pay rise in a decade.

Analysis by the Resolution Foundation indicates that the national minimum wage will rise by 15p to £8. An initiative from: Toggle navigation. The SAWB meets twice a year in order to determine the minimum gross wages payable to agricultural workers and to set conditions for holiday and sick pay entitlement. There is also a higher.

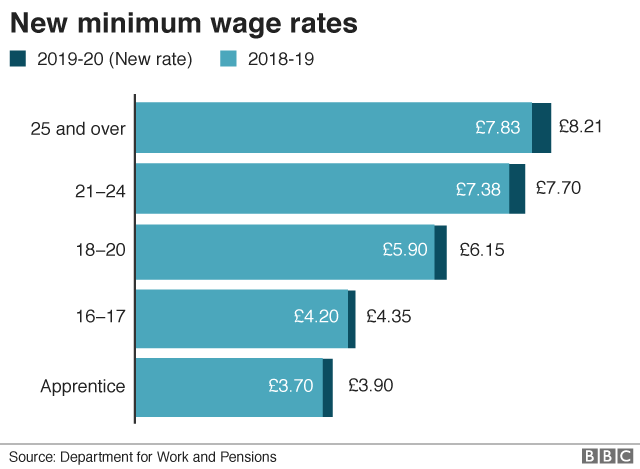

They currently stand at: £7. Minimum wage in scotland - Answered by a verified Career Counselor. We use cookies to give you the best possible experience on our website. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Scottish rate is agreed. Real Living Wage Hourly Rates Increase to £8. However, the new Living Wage rate means the NHS pay agreement in England and Wales falls short, as the lowest rate for Band and will be £9.

If HMRC finds that an employer has not paid at least the minimum wage, they can send a notice of arrears plus issue a penalty for not paying the correct rate of pay. The maximum fine for non-payment is £20per worker. The minimum wage still applies for workers aged and under. At present, the minimum wage - the legal amount Britons are required to be paid at the least - stands at £8.

But this amount was expected to increase to £9. According to the Living Wage Foundation, the main benefit of paying workers the Living Wage is that it can increase employee retention, decrease absenteeism, and enhance the quality of work produced.

Non-payment of the NMW, NLW, or Living Wage. The average hourly pay for a Construction Laborer in United Kingdom is £9. Visit PayScale to research construction laborer hourly pay by city, experience, skill, employer and more.

National Living Wage. That’s why it’s more important than ever for leading employers to join the growing movement of businesses and organisations that are going further than the government minimum and making sure their employees earn enough to cover. The new real London Living Wage is £10. Self-employed workers in the UK, company directors, and volunteers are not required to receive the minimum wage.

Your net wage is found by deducting all the necessary taxes from the gross salary.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.