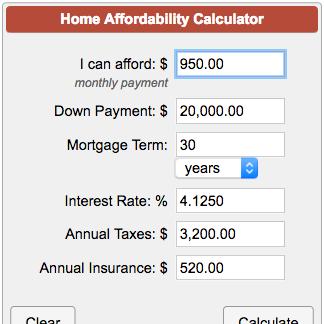

When you apply for a mortgage, lenders calculate how much they’ll lend based on both your income and your outgoings – so the more you’re committed to spend each month, the less you can borrow. This calculator provides useful guidance, but it should be seen as giving a rule-of-thumb result only. This tool will help you estimate how much you can afford to borrow to buy a home. We’ll work it out by looking at your income and your outgoings.

Mortgage lenders will look at these figures very closely to work out how much they’ll offer you. It should take about five minutes to complete. However, you may still complete an Agreement in Principle (AIP) to see how much you could borrow. There are products offered to.

Tool=mortgage_calculator The lowest. Usually the amount you can borrow is around 2. How much can I afford to borrow as a mortgage ? Our calculators give you a rough idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be for various types of mortgage. The actual amount you could borrow will depend on a number of factors, including the amount of deposit you have, any outstanding credit commitments and your monthly outgoing.

Once you have an idea of how much you can affor our simple mortgage tables will show you what your monthly payments are likely to be for the duration of the initial rate period and once you move into the standard rate. The maximum you could borrow from most lenders is around: £ Show me how it works The calculation shows how much lenders could let you borrow based on your income.

This is known as the loan-to-income ratio. Now, when you apply for a mortgage, the lender will cap the loan-to-income ratio at four-and-a-half times your income.

You could consider taking out life, or life and critical illness insurance alongside your mortgage. These covers are designed to offer some financial protection against the unexpected. Your loved ones would receive a lump-sum payment if you died an depending on your cover, could receive a lump sum if you were diagnosed with a critical illness, which could help repay your mortgage. Develop or Renovate.

Initiate Buy-to-lets. Profitable property supported by fast and cost effective bridging loans. Find Out How Low Rates Could Benefit You. Contact The Mortgage Buyer to Receive Personal Customer Service and The Best Cash Pricing.

Sell Your Note to an Experience Reputable Note Buyer You Can Trust to Treat You Fairly. A bigger deposit gives you more options and lower rates.

The size of your deposit will make a massive difference to the mortgage deal you can find. If you’re buying or remortgaging a buy to let property or you already have a buy to let mortgage with us, you can view our interest rates to find the best deal for you. So, please leave these fields blank.

This will allow us to accurately work out how much we can lend you at this time. Typically, lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. On an interest rate of 3. The first is when you already have a mortgage on a property but you’d like to switch to a different mortgage deal. This can be with the same lender or another one.

The second meaning, the one which is relevant to this instance, is to apply for a mortgage on a property when there is no longer a mortgage outstanding on that property. Most mortgage lenders have an upper age limit for their lending, typically one for taking out new mortgages (normally to 70) and another for paying them off (between and 85).

Having five per cent of the value of the property you wish to buy is no guarantee you will be accepted for a mortgage. Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30per year and the lender will lend four times this, they may be willing to lend £12000.

You must be able to demonstrate you have an acceptable repayment strategy in place to repay the mortgage amount in full upon expiry. A mortgage of £137payable over years, initially on a fixed rate for years at 2. LTV Mortgages, 90% LTV Mortgages and 85% LTV Mortgages are at the high end of available LTVs, offering the most expensive rates, but can help first time buyers get onto the property ladder.

A retirement interest-only mortgage is a new way for older borrowers and people over to get a mortgage on their home. Find out how they work, which providers offer retirement mortgages, and how a retirement mortgage compares to equity release.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.